How much margin do I need to place an order?

Are the margin rates the same for all instruments?

Are the margin rates the same for all instruments?

No. Margin![]() The required collateral to open and maintain a leveraged position. rates depend on the regulatory requirement for each instrument. Refer to our website for the current margin rates for each instrument.

The required collateral to open and maintain a leveraged position. rates depend on the regulatory requirement for each instrument. Refer to our website for the current margin rates for each instrument.

How is the required margin calculated?

How is the required margin calculated?

Margin_Used = Margin_Rate * Trade![]() The actual execution of buying or selling an asset, resulting in a completed transaction._Quantity * Instrument_To_Home_Ccy Conversion current mid-rate

The actual execution of buying or selling an asset, resulting in a completed transaction._Quantity * Instrument_To_Home_Ccy Conversion current mid-rate

Refer to margin calculations for a v20 sub-account on OANDA platforms.

How do I know how much margin is required?

How do I know how much margin is required?

OANDA platforms

OANDA platforms

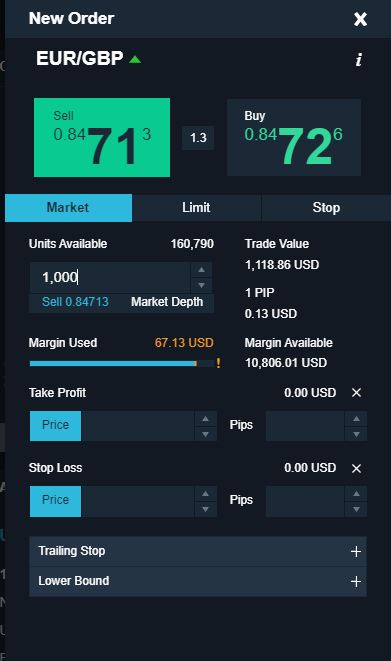

You do not have to calculate the margin requirements to place an order because OANDA platforms make that information available to you. When you enter your order requirements, the order ticket on our platforms clearly shows Margin Used which is the margin required to place that specific order.

In the following example, as per the order ticket on the OANDA web platform, the margin required on a 1000 units trade of EUR/GBP would be $67.13 USD in a USD sub-account.

Third-party platforms

Third-party platforms

TradingView order tickets provide a Margin Used value, but it's an approximation. This is because TradingView calculates Margin Used using sided prices (bid/ask), whereas OANDA platforms use mid prices.

MetaTrader order tickets do not provide Margin Used calculations.