What is depth of market?

What is depth of market?

Depth of market is the display of the available quantity at each price for a product. It may consist of a few levels, each displaying a different price and number of units available at that price.

What are the benefits of depth of market?

What are the benefits of depth of market?

Depth of market provides greater transparency by displaying price levels, which organize prices by the number of units available at each price. This enables access to reduced spreads on smaller trade sizes and enables you to place larger trades in single transactions.

Where can I access depth of market?

Where can I access depth of market?

You can access depth of market through an order ticket on OANDA desktop or web platform by clicking on Market Depth, and on OANDA mobile app by tapping DOM.

For information on accessing depth of market on MT4, refer to the MT4 user guide.

Does depth of market apply to all order types?

Does depth of market apply to all order types?

Yes, depth of market can be applied to all available order types. This includes entry (market, limit and stop) and exit (stop-loss, trailing stop-loss and take-profit) orders.

How does depth of market affect order execution on limit orders?

How does depth of market affect order execution on limit orders?

If an order is submitted with a number of units greater than the number available on the first level, then the limit order will only trigger upon the applicable sell/buy price reaching the depth of market price, instead of the top of book level. For information on other order types, refer to the how are orders filled topic.

Which asset classes does depth of market apply to?

Which asset classes does depth of market apply to?

The depth of market functionality applies to all asset classes, but the levels of depth will vary across instruments – some may only have one level. You can view the current market depth for an instrument by opening the order ticket and clicking on the Market Depth/DOM window.

How can I calculate a price for an order filled at depth?

How can I calculate a price for an order filled at depth?

Let’s say an order for 10,000 is being submitted. The depth of market window highlights the applicable levels.

-

To calculate the resulting Volume Weighted Average Price for this order, first multiply each level’s price by the number of units at that level. Continue down the depth until all of the order quantity has been filled and then sum up the total. In this example, we do not need to use the fifth level, (price 140), as the requested number of units is satisfied from the first four levels.

-

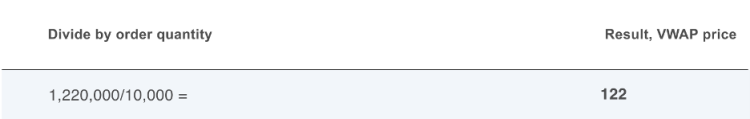

This results in a notional value of 1,220,000 for the order. 2. Next, divide the notional value by the quantity of units of the order to obtain a VWAP price. In this case, it’s 10,000:

This gives an order “VWAP” price of 122.

Is depth of market available on MT4?

Is depth of market available on MT4?

The basic version of MT4 platform does not support depth of market. To access it on MT4, download and install OANDA's premium upgrade.

How are Upper Bounds affected by Market Depth?

How are Upper Bounds affected by Market Depth?

If an Upper Bound is applied to an order, the Upper Bound will take the Market Depth price into account and use it for the basis of the Upper Bound calculation.

Can I break one order into multiple smaller orders?

Can I break one order into multiple smaller orders?

If multiple orders are triggered at once when the combination of the orders would require executing at depth, the orders are executed on the same basis as if they were combined as one order. Therefore, the first order would consume a portion of the depth of market, the second order would carry on from where the first order concluded and so on for each of the orders.

Where can I learn more about depth of market?

Where can I learn more about depth of market?

You can learn more about depth of market by visiting our website.