Financing costs for OANDA Australia

How are financing costs calculated?

How are financing costs calculated?

Refer to our detailed webpage on financing costs. The page also answers the following questions:

-

How are financing costs affected by settlements in the underlying asset and the impact of weekends and public holidays?

-

Why are financing costs applied to your account?

-

How do financing cost calculations differ for long and short positions?

-

What are the daily funding rates and associated anticipated daily financing costs?

Where can I find the current and historic daily financing costs for all instruments?

Where can I find the current and historic daily financing costs for all instruments?

In the Daily financing cost section of the financing costs page, you can select the instrument you want to trade in and the date of reference. The widget will display both the annualised funding rate (including the specific admin fee) and anticipated daily financing cost based on prevailing rates. Additionally, you can also see historic funding rates.

Can you explain the financing cost calculations for FX CFDs?

Can you explain the financing cost calculations for FX CFDs?

Daily financing charge or credit = size of position x applicable funding rate x [trade duration (in days) / 365] x conversion rate to account currency

In the hypothetical example below, we assume the following funding rates (sample rates that don’t reflect the current swap rates):

| Instrument | Long funding rate (annual) | Short funding rate (annual) |

| EUR/USD | -3.00% | +1.60% |

The resulting financing cost will vary based on factors explained in the following scenarios:

Scenario 1:

You open a long 100,000 EUR/USD trade at 8:30am ET Wednesday and close it at 3:30pm ET Wednesday. There will be no financing cost because no open position is held at 5pm ET end of day.

Scenario 2:

You open a long 130,000 EUR/USD trade which remains open after 5pm ET Tuesday.

The daily financing cost = 130,000 x -3.00% x 1/365 = -10.68 EUR.

Thus, a financing charge of 10.68 EUR, converted to your account home currency, is levied on your account. Your account will be charged every day the position is held beyond 5pm ET.

Scenario 3:

You are short 130,000 EUR/USD trade which remains open after 5pm ET Wednesday.

The daily financing for this position is 130,000 x 1.6% x 1/365 = 5.70 EUR.

However, as this position is held past 5pm ET Wednesday, weekend financing will apply. The total credit received will be for 3 days i.e. 5.70 x 3 = 17.10 EUR. A financing credit of 17.10 EUR, converted to your account home currency, will be applied to the account.

Can you explain the financing cost calculations for Index CFDs?

Can you explain the financing cost calculations for Index CFDs?

Daily financing charge or credit = value of position* x applicable funding rate x [trade duration (in days) / 365] x conversion rate to account currency; where *value of position = size of position x price at the end of trading day (5pm ET)

In the hypothetical example below, we assume the following prices and funding rates (sample values that don’t reflect the prevailing reference rates):

| Instrument | Long funding rate (annual) | Short funding rate (annual) | Long/buy price (ET 5pm) | Short/sell price (ET 5pm) |

| US SPX 500 | Prevailing financing reference rate + 2.5% admin fee. For example: 1.50% + 2.5% = 4.00% | Prevailing financing reference rate – 2.5% admin fee. For example: 4.50% - 2.50% = 2.00%. | 3040.50 | 3040.42 |

The resulting financing cost will vary based on factors explained in the following scenarios:

Scenario 1:

You are long 1 unit of US SPX 500 (S&P 500) trade that remains open after 5pm ET Tuesday.

Financing cost = (1 x 3040.50) x 4.00% x 1/365 = 0.33 USD.

Thus, a financing charge of 0.33 USD, converted to your account home currency, will be levied to your account. This cost will be charged every day the position remains open after 5pm ET.

Scenario 2:

You are short 10 units of US SPX 500 trade that remains open after 5pm ET Friday.

Financing cost = (10 x 3040.42) x 2.00% x 1/365 = 1.66 USD.

However, as this position is held past 5pm ET Friday, weekend financing will apply. The total credit received will be for 3 days i.e. 1.66 x 3 = 5 USD. A financing credit of 5.00 USD, converted to your account home currency, will be applied to your account.

Can you explain the financing cost calculations for Commodity CFDs?

Can you explain the financing cost calculations for Commodity CFDs?

Financing charge or credit = position size x funding rate x [trade duration (in days) / 365] x conversion rate to account currency; where *value of position = size of position x price at the end of trading day (5pm ET)

In the hypothetical example below, we assume the following funding rates (sample values that don’t reflect the current basis rates):

| Instrument | Long funding rate (annual) | Short funding rate (annual) | Price |

| Brent Crude Oil | Basis rate + 2.5% admin fee = 5% + 2.5% = 7.5% | Basis rate – 2.5% admin fee = 5% - 2.5% = 2.5% | 63.00 USD |

| Natural Gas | Basis rate + 2.5% admin fee = -20% + 2.5% = -17.5% | Basis rate – 2.5% admin fee = -20% - 2.5% = -22.5% | 2.50 USD |

The resulting financing cost will vary based on factors explained in the following scenarios:

Scenario 1:

You have a 100-unit long position of Brent Crude Oil, which was opened between 3:00am and 3:00pm ET.

Financing cost = 100 x (5.00% + 2.50%) x (0.5 / 365) x 63.00 = 0.65 USD.

Thus, a financing charge of 0.65 USD will be applied to your account. In this example, the charge offsets the trading profit that results from the price trending upward towards the next contract price (indicated by the +5% basis rate).

Scenario 2:

You have a 400-unit short position of Brent Crude Oil, which was opened between 9:00am ET and 3:00pm ET.

Financing credit = 400 x (5.00% - 2.50%) x 0.25 / 365 x 63.00 = 0.43 USD.

Thus, a financing credit of 0.43 USD will be applied to your account. In this example, the credit offsets the trading loss that results from the price trending upward.

Scenario 3:

You have a 100,000-unit long position of Natural Gas, which was opened between 2:00am ET and 2:00pm ET. The position was open for 12 hours i.e. 0.5 day.

Financing amount = 100,000 x (-20.00% + 2.50%) x (0.5 / 365) x 2.50 = -59.93 USD.

Since the resulting amount to be debited is negative, a financing credit of 59.93 USD will be applied to your account. In this example, the credit offsets the trading loss that results from the price tending downward (indicated by the -20% basis rate).

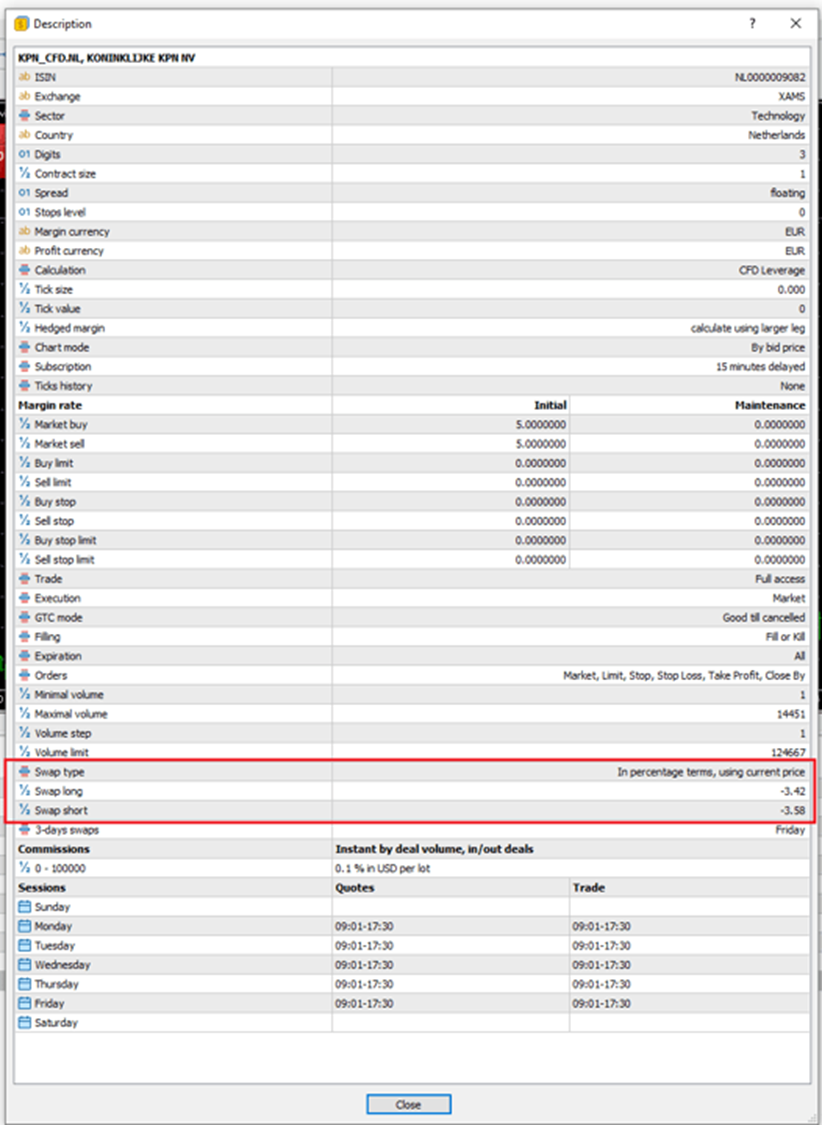

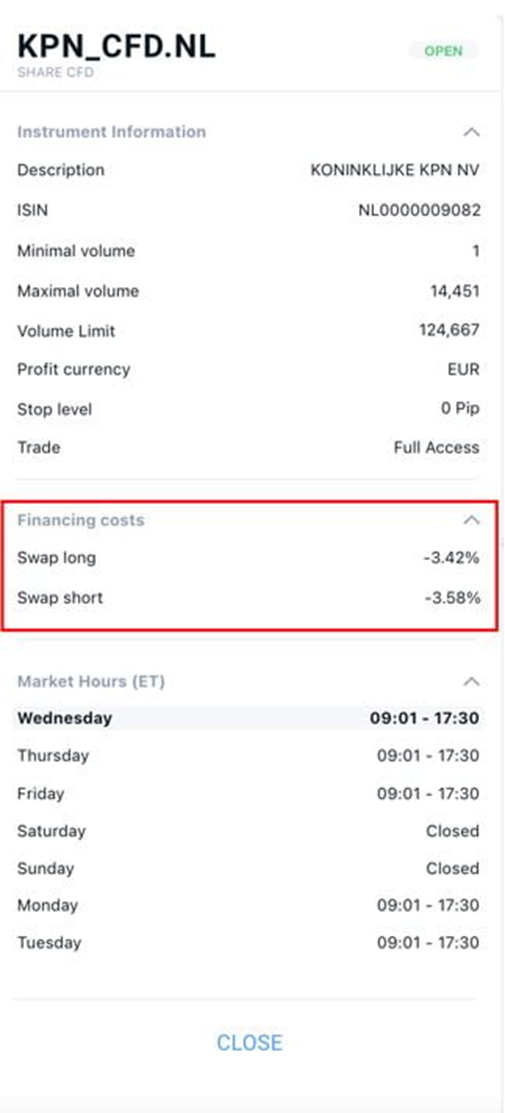

Can you explain the financing cost calculations for Share CFDs?

Can you explain the financing cost calculations for Share CFDs?

Daily Financing charges or credits are calculated on positions that are open at the end of each trading day, at 5pm ET.

Daily financing charge or credit = value of position* x applicable funding rate x [trade duration (in days) / 365] x conversion rate to account currency; where *value of position = size of position x price at the end of trading day (5pm ET)

| Instrument | Daily long funding rate | Daily short funding rate | Long/buy price (ET 5 p.m.) | Short/sell price (ET 5 p.m.) |

| XYZ Share CFDs | Prevailing Reference rate annualised, plus admin fee 2.5%. For example: 4.5% + 2.5% = 7.0%. This total is debited as a charge represented by -7.0% | Prevailing Reference rate annualised minus admin fee 2.5% increased by the 0.5% additional cost of borrowing*. For example: 4.5% - (2.5% + 0.5%) = 1.50%. The reference rate is higher than the admin fee. Hence, the difference is credited as an amount represented by 1.50%. | €182 | €180 |

*Admin fee may be increased by the additional cost of borrowing rates for short positions held overnight. Additional costs of borrowing rates are dependent on instrument liquidity. Typically they are 0.5%, but for some, very illiquid and 'hard-to-borrow' instruments additional costs of borrowing may be significantly higher.

The resulting financing cost will vary based on factors explained in the following scenarios:

Example 1:

You have 100 units of XYZ Share CFDs; it’s a long trade open at 5pm ET Tuesday.

Financing cost = (100 x €182) x -7% x 1/365 = -€3.49.

A financing charge of €3.49, converted to your account home currency, will be applied to your account.

Example 2:

You have 100 units of XYZ Share CFDs; it’s a short trade open at 5pm ET Friday.

Financing cost = (100 x €180) x 1.50% x 3/365 = €2.22.

A financing amount of €2.22, converted to your account home currency, will be credited to your account.

Can you explain the financing cost calculations for Cryptocurrency CFDs?

Can you explain the financing cost calculations for Cryptocurrency CFDs?

Financing charge or credit = position size x funding rate x [trade duration (in days) / 365] x conversion rate to account currency

In the hypothetical example below, we assume the following funding rates (sample values that don’t reflect the prevailing financing reference rates):

| Instrument | Long funding rate (annual) | Short funding rate (annual) |

| Bitcoin CFD | -15% - SOFR. For example, -15% - 4.33% = -19.33% | 0% + SOFR. For example, 0% + 4.33% = 4.33% |

Scenario 1:

You are long 1 Bitcoin @ $96000 and this position remains open after 5pm ET Tuesday.

Financing cost = 1 x (-19.33%) x (1/365) = -0.0005295890411 BTC.

Thus, a financing charge of -0.0005295890411 BTC converted to your home currency will be applied. This will be charged every day the position remains open after 5pm ET.

Scenario 2:

You are short 1 Bitcoin @ $96000 and this position remains open at 5pm ET Monday.

Financing credit = 1 x 4.33% x (1/365) = 0.000118630137 BTC.

Thus, a financing credit of 0.000118630137 BTC converted to your home currency will be applied. This will be charged every day the position remains open after 5pm ET.