Register for a new account. Already started? Sign in to resume registration.

The application requirements to open an account with OANDA vary based on the region in which you reside. To comply with AML/CTF requirements, OANDA is required to gather information to understand all our customers, including information about our customers’ source of funds and wealth. This information is kept strictly confidential.

Can I apply to open an account?

Can I apply to open an account?

Residents of Australia and Australian overseas territories may apply for an OANDA Australia account.

To get more information about our specific divisions , please visit our website.

What types of accounts are available?

What types of accounts are available?

For more information about account types , please visit our website.

Actions to ensure swift processing of my application

Actions to ensure swift processing of my application

To ensure your account is processed in a timely manner, please provide current and complete information. Avoid abbreviations and pay attention to application details like ‘currency type’, when providing figures etc.

If you are asked to provide supporting documents, please be sure to follow our proof of identity and proof of address guidelines below.

What information do I need to provide to open an account?

What information do I need to provide to open an account?

-

Name

-

Contact number and email address

-

Address

-

Date of birth

-

Citizenship

-

Driver's license details (or other identification information where applicable, i.e. Passport/Medicare)

-

Employment and Financials

-

Risk & Experience

-

Knowledge Quiz

Residents of Australia: we will do our best to identify your identity electronically by matching the details you supplied during registration to details in your credit file, known as electronic identification (EID).

Monitor your inbox (including your junk folder) after submitting your application as we may request further supporting documentation and/or clarification of the information you provided during registration.

Even if you pass EID, keep monitoring your inbox and junk folder, as a member of our Onboarding team may reach out to you to confirm or clarify details on your application.

Is my application complete?

Is my application complete?

Uploading your documents does not complete registration. A member of the Onboarding team will review your application and be in touch via email either for further details or to let you know your account has been approved and is ready for funding.

Do I need to provide supporting documents to open an account?

Do I need to provide supporting documents to open an account?

Some applicants may be prompted to upload the following documents:

- Proof of identity

- Proof of address

Monitor your inbox (including your junk folder) after submitting your application as we may request further supporting documentation and/or information, such as:

- Alternative/second proof of identity

- Alternative/second proof of address

- Code verification

- Clarification of your profile details

Proof of identity

We accept:

Valid government-issued photo identification that clearly displays:

- Your photo

- Your full name

- Your date of birth

- Your nationality (if applicable)

- Unique identification number

- Date of issue and/or expiry

- High resolution, clear, colour images of the front and back of your identity document

- A copy of the full document

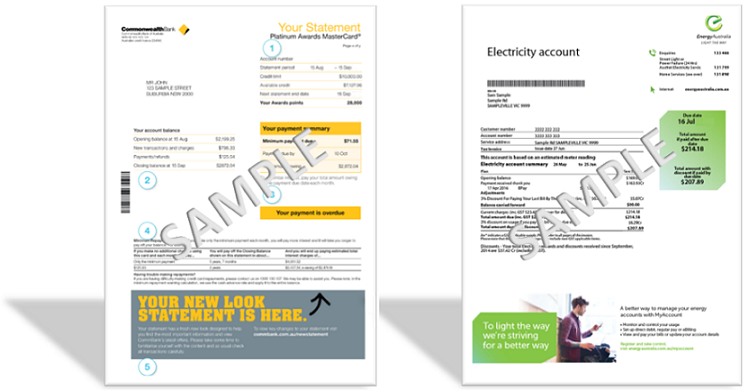

The following images show the identity document types that we may accept:

Proof of address

We accept:

A utility bill, bank statement or credit card bill. This document must:

- Be issued in your name

- Show your current residential address (we cannot accept P.O. boxes or business addresses)

- Be dated within the last three months.

Government-issued photo identification can also be used as proof of address.