What are the requirements to open an account?

Live trading account

Live trading account

How to apply for a live account?

How to apply for a live account?

In most cases, you can open your live account in 3 easy steps:

- Apply for a live account. For more information, refer to our detailed application procedure.

- Fund your account

- Trade

The actual execution of buying or selling an asset, resulting in a completed transaction.

The actual execution of buying or selling an asset, resulting in a completed transaction.

Can I apply to open an account?

Can I apply to open an account?

Residents of countries listed on this page may apply for an OANDA Global Markets account. Applicants should be over the age of 18. We cannot accept applications from third parties.

What types of accounts are available?

What types of accounts are available?

For more information about account types, visit our website.

Do I need to submit documentation for identity verification?

Do I need to submit documentation for identity verification?

The majority of clients do not need to submit documentation for identity verification when they open a trading account as long as they deposit or withdraw up to US$9,000*

*See exceptions below:

-

ID verification is needed for deposits over US$9,000. The sections below can help guide you through the verification process.

-

ID verification is required for deposits by WISE regardless of the amount deposited.

-

Based on our review of your account, we may contact you for additional documentation and verification.

Actions to ensure swift processing of my application

Actions to ensure swift processing of my application

To ensure your account is processed in a timely manner, please provide current and complete information. Kindly try to avoid abbreviations and pay attention to application details like ‘currency type’, when providing figures etc.

What information do I need to provide for ID verification whenever applicable?

What information do I need to provide for ID verification whenever applicable?

We usually ask for a copy of your passport and bank statement dated within the last 3 months for full account verification.

A member of our onboarding team will review the documents you send us. We will notify you once the funding restrictions have been lifted.

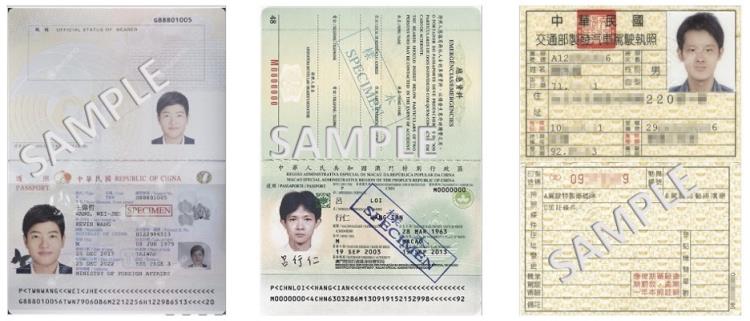

If you do not have a passport, we may accept the following:

- National ID card (front and back)

- Driving license (front and back)

Below are examples of the kind of identity documents that we may accept:

Guidelines for submitting digital images

- Minimum resolution of 300 DPI and image size between 800 KB to 1.5 MB

- The preferred image format is JPG. We also accept BMP, GIF, PNG, TIFF and PDF

- The image must show all document edges

- The image background must be plain and not include more than one document

- Images must be clear with no glare, reflections or pronounced shadows on the document.

We cannot accept:

- Expired documents

- Images of copies

- Black and white, grayscale or monochrome images and images that have had a filter applied to the image

- Partial images

- Altered images with blocked/blurred/distorted images/information or cropped will need to be re-submitted

- Significantly pixelated images or documents captured from a great distance

- Damaged and/or worn documents may not be acceptable

Based on our review of your account, you may be required to provide one of the following documents as well:

-

Judicial authority papers i.e. court papers and summons

-

Public sector body or authority papers e.g. tax, fines, etc.

-

Electricity or water or gas bills.

-

Landline telephone or internet invoice, but NOT mobile phone bills.

-

Bank or credit card statement.

Is my application complete?

Is my application complete?

Uploading your documents does not complete registration. A member of the Onboarding team will review your application and be in touch via email.

Demo trading account

Demo trading account

How to apply for a demo account?

How to apply for a demo account?

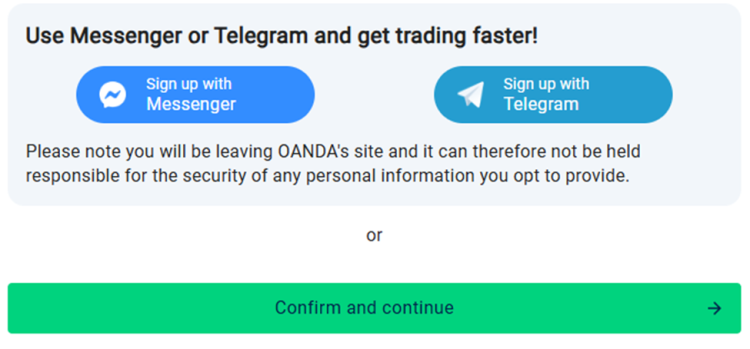

Application form

To open your demo account, follow these steps

-

Apply for a demo account.

-

Complete the application using our sign-up form by clicking on Confirm and continue (recommended) or Messenger or Telegram.

-

Receive an email with your login credentials.

-

Download the trading platform and practice trading.

What should you keep in mind while opening a demo trading account using Messenger or Telegram?

What should you keep in mind while opening a demo trading account using Messenger or Telegram?

We allow our clients to create demo accounts using chatbots in Messenger and Telegram.

We might also reach out to you via Whatsapp or other messaging applications to provide you with some assistance.

Under no circumstances should you upload any personal documentation such as ID documents or bank statements via these messaging applications. You should also never include any bank account information. We would never ask you to do so.

If you wish to provide us with documents or bank account information, you should always use our secure portals for this purpose.

Who can apply for a demo trading account?

Who can apply for a demo trading account?

Residents of countries listed on this page may apply for an OANDA account. You must be over the age of 18. We cannot accept applications from third parties.