Trading Share CFDs means you will not acquire any physical holdings of shares; you will only trade the performance of the underlying asset.

You can trade Share CFDs offered on MetaTrader 5 (desktop, web, tablet and mobile) and OANDA (mobile only) platforms.

How can I trade Share CFDs?

How can I trade Share CFDs?

All accounts are eligible to trade Share CFDs. You can use any of your existing MT5 sub-accounts to trade all Share CFDs except the U.S Share CFDs.

Unlike other Share CFDs, U.S Share CFDs are not available by default. You must submit the relevant tax declaration and be approved for trading U.S Share CFDs. When approved, you must create a new MT5 sub-account to start trading U.S Share CFDs. For more information, refer to the tax declaration FAQ.

What are the minimum and maximum order sizes?

What are the minimum and maximum order sizes?

The minimum order size is 1 lot, which is equal to 1 share. You can’t take fractional positions.

The maximum order size depends on the instrument. If you attempt an order that exceeds the maximum order size, the trade ticket in the platform will not allow you to enter that amount.

What is the maximum position size?

What is the maximum position size?

OANDA allows clients to take positions up to a maximum position size on a per symbol basis. This maximum exposure is on a per client basis; and therefore applies to cumulative positions over all your trading accounts with OANDA.

This maximum position size is shown in your trading platform. In MT5 this is defined as the Volume Limit in the symbol specification or in the OANDA mobile platform it is noted as Maximum Client Exposure![]() The current market value of all the positions a trader holds. Higher exposure magnifies potential gains or losses. in the Instrument Information section of the platform.

The current market value of all the positions a trader holds. Higher exposure magnifies potential gains or losses. in the Instrument Information section of the platform.

What is the applicable pricing?

What is the applicable pricing?

For live accounts, the price you see in your trading platform is the current Exchange price.

When you enter or exit a trade on Share CFDs, we charge a commission of 0.10%. There is no minimum commission amount.

- The opening and closing commissions are payable on the opening of the positions.

- The commission is charged in the currency of the Share CFDs and then converted to your account currency using the current currency conversion rates.

- This pricing applies to all account types.

For example, a 100 CFDs long trade in Adidas at a price of €184.94 would incur a total commission (opening and closing) of €36.988 based on the following calculation:

100 (units) x €184.94 (price) x 2 = €18494 x 0.10% x 2 = €36.988

The commission is charged in the currency of the Share CFDs and then converted to your account currency using the current currency conversion rates.

Is leverage trading available?

Is leverage trading available?

OANDA offers leverage or margin for trading Share CFDs. Please visit our website for current margins.

What are the hours of operation?

What are the hours of operation?

Please refer to our website for trading hours of Share CFDs.

Why am I not able to open new trades or short sell certain instruments?

Why am I not able to open new trades or short sell certain instruments?

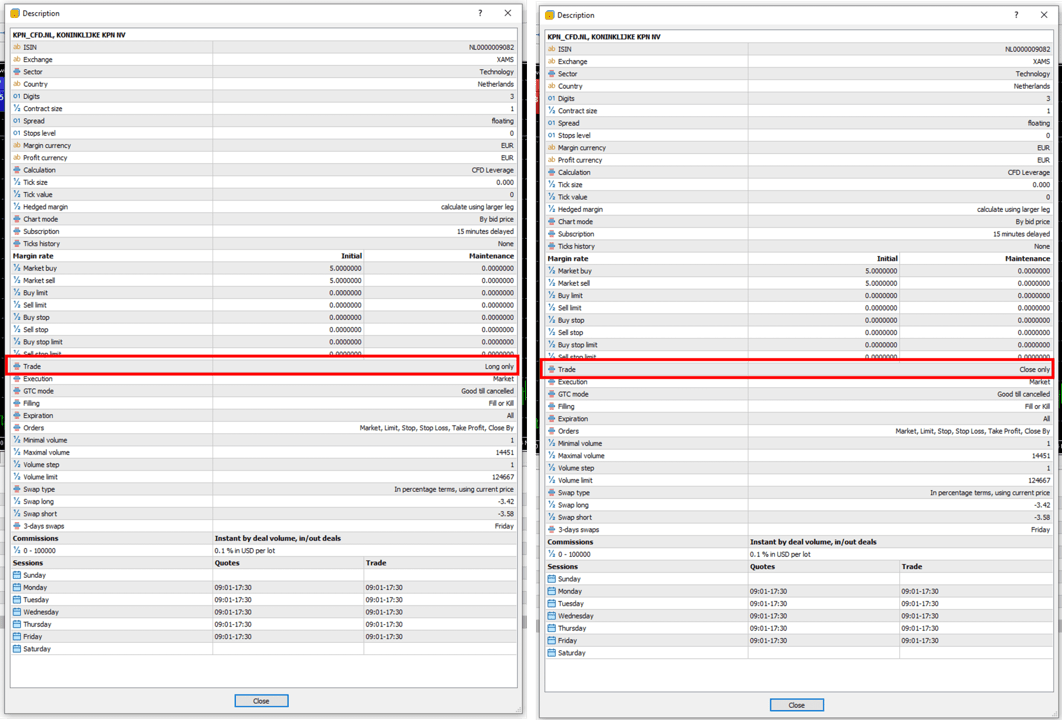

Certain market conditions may affect an instrument’s availability. OANDA may decide to make them ‘close-only’ or ‘long-only’. Instruments that are not available for full trading are listed in the Trading Status Exceptions table on our website . For more information, refer to our terms and conditions.

In case of U.S Share CFDs, if the tax declaration submitted by you has been invalidated or has expired, the instruments will be set to ‘close-only’. You must submit a new tax declaration to resume full trading. For more information, refer to our tax declaration FAQ.

An instrument’s trade status is visible in our platforms as shown in the following images:

What are corporate actions?

What are corporate actions?

Corporate actions are events carried out by a publicly traded company and have an impact on its shareholders. Examples of corporate actions include the following:

- Dividends

- Stock splits

- Rights issues

- Mergers, takeovers & acquisitions

- Spin-offs

- Bonus issues

When will my account be debited or credited in line with a corporate action?

When will my account be debited or credited in line with a corporate action?

As soon as we receive the debit or credit for the share CFDs you hold, we will pass it on to you. You can view your account statements. The following table explains how to identify transactions related to corporate actions:

| Corporate Action | Comment in Account Statement |

|---|---|

| Dividend | Dividend |

| Split or Reverse Split | Split_adj |

| Spin off | Spinoff_adj |

| Rights issue | Rights_adj |

| Acquisition or Merger | Acq_merg_adj |

| Bonus Issue | Bonus_adj |

| Stock Dividend | Stockdiv_adj |

| Tax | Tax |

| Tax Equivalent | Tax_equivalent |

The comment you see in your statement and in your MT5 platform will be followed by the trade ID number of the transaction to which the charge applies.

Why do you make deductions when you calculate dividend or other corporate action adjustments?

Why do you make deductions when you calculate dividend or other corporate action adjustments?

The following two deductions apply to long positions:

-

Tax: Dividends on some Share CFDs may be subject to taxes, depending on the jurisdiction where the stock is listed. Tax treatment of dividends can differ depending on your country of tax residency and whether tax treaties are in place.

-

Tax Equivalent: For Share CFDs on companies listed in jurisdictions that do not apply withholding taxes on CFDs, Tax (as described above), would not be applicable. However, for the Share CFD positions you hold, our liquidity providers hold an equivalent position in the underlying shares as a hedge. Thus, our liquidity providers receive the actual dividend which is subject to tax that is applicable to them. We then pass on the economic value of this net dividend to you. In these products, the difference between the gross and the net dividend value is termed as tax equivalent.

For more information on the applicable rates of deductions, refer to our website .

On short positions, there are no tax or tax equivalent adjustments.

How do corporate actions impact me?

How do corporate actions impact me?

Refer to our website to understand how corporate actions impact you. Additionally, the following examples may help you understand the implications.

Any charges or tax equivalents applied against us by our liquidity providers will be passed on while calculating the required adjustments.

In the case of U.S Share CFDs, there may be tax implications. When applicable, the tax rate used to calculate taxes will be determined based on the tax declaration you submitted at the time of activation.

Impact of dividends

Impact of dividends

In this hypothetical example, you are holding a long position of 1 Share CFD of Adidas which is trading at €184.94. Adidas announces a dividend of €10 per share. On the ex-dividend date, the value of the Adidas Share CFD would, in theory, fall to €174.94.

We will credit your account by the value of the dividend and debit it by any applicable tax or tax equivalent.

Credit applied = €10 (value of the dividend)

Charges applied = €10 x 26.375% = €2.64 (tax or tax equivalent, as applicable, on German share CFDs)

Conversely, if you are holding a short CFD position in Adidas, on the day of the ex-dividend date the position would see an increase in value. OANDA would debit the account by the amount of the gross dividend.

Impact of stock dividends

Impact of stock dividends

In this hypothetical example, you are holding a long position of 150 Share CFDs of Adidas. Each Adidas Share CFD is trading at €184.94. Adidas announces a stock dividend, where for every 100 shares held you would receive 1 additional share as a dividend. On the ex-dividend date, the value of Adidas Share CFD would, in theory, fall to €183.10.

We will credit your account with cash equivalent to the stock dividend.

Credit applied = Cash equivalent of the stock dividend

Credit applied = €183.10 x 1.5

Credit applied = €274.65

Charges applied = €1.83 x 1.5* 26.375% = €0.72 (tax or tax equivalent, as applicable, on German share CFDs)

Conversely, if you are holding a short CFD position in Adidas on the day of the ex-dividend date, you would see an increase in value. Thus, cash equivalent to the dividend will be deducted from your account.

Impact of bonus issues

Impact of bonus issues

The impact is the same as that of stock dividends.

Impact of stock splits

Impact of stock splits

Example 1:

In this hypothetical example, you are holding a long position of 10 Share CFDs of Deutsche Bank purchased at €10 per share. Deutsche Bank announces a 2 for 1 stock split.

As a result, we will close your position of 10 Deutsche Bank Share CFDs at €10 per share and open a new position of 20 Deutsche Bank Share CFDs at €5 per share. The notional value of your position, before and after this split, remains the same.

A short share position will be similarly impacted.

Example 2:

In this hypothetical example, you are holding a long position of 5 Share CFDs of Deutsche Telekom purchased at €15 per share. Deutsche Telekom announces a 3 for 2 stock split.

We will close your position of 5 Deutsche Telekom CFDs at €15 per share and open a new position of 7 Deutsche Telekom CFDs at €10 per share.

When the shares are split, there is a fractional position of 0.5 share, which is closed in this split operation and you will receive cash compensation for that closure noted on your account as "split adjustment". The compensation will be the P&L for that 0.5 share. This P&L would be the difference between the purchase price and the price at the time of the split.

A short Share CFD position would be similarly impacted.

Impact of reverse stock splits

Impact of reverse stock splits

Example 1:

In this hypothetical example, you are holding a long position of 10 Share CFDs of Deutsche Bank purchased at €10 per share. Deutsche Bank announces a 1 for 2 reverse stock split.

As a result, we will close your position of 10 Deutsche Bank Share CFDs at €10 per share and open a new position of 5 Deutsche Bank Share CFDs at €20 per share. The notional value of your position, before and after the reverse split, remains the same.

A short share position will be similarly impacted.

Example 2:

In this hypothetical example, you are holding a long position of 5 Share CFDs of Deutsche Bank purchased at €10 per share. Deutsche Bank announces a 1 for 2 reverse stock split.

We will close your position of 5 Deutsche Bank Share CFDs at €10 per share and open a new position of 2 Deutsche Bank Share CFDs at €20 per share. When the shares are split, there is a fractional position of 1 pre-split share, which is closed in this split operation and you will receive cash compensation for that closure noted on your account as "split adjustment". The compensation will be the P&L for that 1 share. This P&L would be the difference between the purchase price and the price at the time of the split.

A short Share CFD position would be similarly impacted.

Impact of rights issues

Impact of rights issues

In this hypothetical example, you are holding a long position of 10 Share CFDs of Adidas. Adidas announces a rights issue of 1:1.

OANDA offers Share CFDs and not the cash shares and therefore you are not the holder of the 10 rights that would be made available. However, OANDA will sell our gained rights in the marketplace; and on the sale of these rights we will pass the cash equivalent on to your account.

Conversely, if you are holding a short CFD position in Adidas, we will debit your account with the cash equivalent of the sold rights.

Impact of acquisitions and mergers

Impact of acquisitions and mergers

Example 1 - Merger for cash:

In this hypothetical example, you are holding a long position of 900 XYZ German Share CFDs. XYZ is merging with the company ABC. As per the merger agreement, XYZ holders shall receive cash consideration in exchange for their shares of €10 per share.

We would close your position of 900 XYZ Share CFDs at €10 per share according to the terms of the merger.

Short positions would be similarly impacted.

Example 2 Merger for shares:

In this hypothetical example, you are holding a long position of 900 XYZ German Share CFDs. XYZ is merging with the company ABC. As per the merger agreement, XYZ holders shall have their shares exchanged on 1:1 basis for ABC shares.

We would close your position of 900 XYZ Share CFDs by cash settling your holding; the position will be closed based upon the ABC share price as defined in the terms of the merger. In case the merger agreement is silent about the ABC share price, we would consider the market price on the effective date of the merger.

We would close your position of 900 XYZ Share CFDs at ABC’s share price and credit or debit your account accordingly.

Short positions would be similarly impacted.

Impact of spin offs

Impact of spin offs

In this hypothetical example, you are holding a long position of 10 Share CFDs of Adidas. Adidas announces a spin-off, whereby holders of Adidas shares shall receive shares of spun-off company ABC on 1:1 basis.

At OANDA, we would sell the ABC shares at the price defined in the spin-off agreement and credit your account with cash equivalent. In case the spin off agreement is silent about the ABC share price, we would consider the market price when the listing of spun-off shares starts.

Conversely, if you are holding a short CFD position in Adidas, we will debit your account with the cash equivalent to the sold ABC CFDs.