Financing costs for OANDA (Canada) Corporation

This FAQ has financing cost information for FX, metals (except copper and platinum), indices, commodities (including copper and platinum) and bonds. If you are looking for OANDA's daily funding rates and associated anticipated daily financing costs , you can find that via our website .

How does OANDA (Canada) Corporation calculate funding rates?

How does OANDA (Canada) Corporation calculate funding rates?

| Asset class | Funding rates (long/buy positions) | Funding rates (short/sell positions) |

|---|---|---|

| FX and metals (excluding copper and platinum) | Rates are based on a blend of underlying liquidity providers’ tom-next swap rates, adjusted by the instrument specific admin fee, and annualized. On our financing costs webpage, you can select the instrument that you wish to trade, and it will calculate both the annualized funding rate (including the specific admin fee) and anticipated daily financing cost based on prevailing rates. Additionally, you will also see historic funding rates. | Rates are based on a blend of underlying liquidity providers’ tom-next swap rates, adjusted by the instrument specific admin fee, and annualized. On our financing costs webpage, you can select the instrument that you wish to trade, and it will calculate both the annualized funding rate (including the specific admin fee) and anticipated daily financing cost based on prevailing rates. Additionally, you will also see historic funding rates. |

| Indices | Rates are admin fee of 2.5% plus relevant* alternative reference rate , annualized. Represented by a negative rate, and hence a charge.*rate used in the country whose currency is the instruments’ quote currency. On our financing costs webpage, you can select the instrument that you wish to trade, and it will calculate both the annualised funding rate (including the admin fee) and anticipated daily financing cost based on prevailing rates. Additionally, you will also see historic funding rates. | When the relevant* alternative reference rate is greater than our 2.5% admin fee, the rate used will be the difference between the two, annualized. This is represented by a positive rate, and therefore a credit. When the relevant* one-month alternative reference rate is lower than our 2.5% admin fee, the rate used will be the difference between the two, annualized. This is represented by a negative rate, and therefore a charge.*rate used in the country whose currency is the instruments’ quote currency. On our financing costs webpage, you can select the instrument that you wish to trade, and it will calculate both the annualized funding rate (including the admin fee) and anticipated daily financing cost based on prevailing rates. Additionally, you will also see historic funding rates. |

| Index | Alternative reference rate |

|---|---|

| Australia 200 | AONIA |

| China A50 | SOFR |

|

China H Shares |

HONIA |

|

Germany 30 |

ESTR |

|

Europe 50 |

ESTR |

|

France 40 |

ESTR |

|

Hong Kong 33 |

HONIA |

|

India 50 |

SOFR |

|

Japan 225 (USD) |

SOFR |

|

Japan 225 (JPY) |

TONA |

|

US Nas 100 |

SOFR |

|

Netherlands 25 |

ESTR |

|

Singapore 30 |

SORA |

|

Spain 35 |

ESTR |

|

Switzerland 20 |

SARON |

|

US SPX 500 |

SOFR |

|

Taiwan Index |

SOFR |

|

UK 100 |

SONIA |

|

US Russell 2000 |

SOFR |

|

US Wall St 30 |

SOFR |

How are financing costs affected by settlements in the underlying asset and impact of weekends and public holidays?

How are financing costs affected by settlements in the underlying asset and impact of weekends and public holidays?

FX and metals (except copper and platinum) trades typically settle on a T+2 basis, and the funding rate reflects the cost to push forward the settlement date by one day so that you can hold the position indefinitely. If you hold a position on a Wednesday at 5pm, the funding rate will typically be tripled to reflect pushing forward the settlement by three days instead of one day. This is because at the end of Wednesday the settlement date needs to be pushed forward from Friday to Monday, and the funding rate reflects the cost to hold the position over the weekend.

There are no financing costs or credits on Saturday or Sunday. The actual funding rate on any given date may reflect more than one day depending on the instrument or due to market holidays. Indices typically factor in weekend financing on a Friday (tripling the usual daily value), although this timeline is also similarly impacted by market holidays. Below are examples of OANDA’s financing costs:

Examples of forex (FX) financing costs (illustrative purposes only)

Examples of forex (FX) financing costs (illustrative purposes only)

Assumptions:

| Instrument | Daily long funding rate | Daily short funding rate |

|---|---|---|

| EUR/USD | -3.00% | +1.60% |

Example 1

Client opens a long 100,000 EUR/USD trade at 8:30am ET Wednesday and closes it at 3:30pm ET Wednesday.

Result: there are no financing costs for this client, as no open position is held at 5pm ET end of day.

Example 2

Client has a long 130,000 EUR/USD trade open at 5pm ET Tuesday.

Financing cost = 130,000 x -3.00% x 1/365 = -10.68 EUR

Result: a financing charge of 10.68 EUR, converted to the client’s account home currency will be levied on their account.

Example 3

Client has a short 130,000 EUR/USD trade open at 5pm ET Wednesday.

Financing cost = 130,000 x 1.6% x 3/365 = 17.10 EUR

Result: a financing credit of 17.10 EUR, converted to the client’s account home currency will be applied to their account.

Examples of financing costs for indices (illustrative purposes only)

Examples of financing costs for indices (illustrative purposes only)

Assumptions:

| Instrument | Daily long funding rate | Daily short funding rate | Long/buy price (ET 5pm) | Short/sell price (ET 5pm) |

|---|---|---|---|---|

| US SPX 500 | Alternative reference rate annualized + an admin fee of 2.5%. For example: 1.50% + 2.50% = 4.00% | Alternative reference rate annualized less admin fee For example: 4.50% - 2.50% = 2.00% | 3040.50 | 3040.42 |

Example 1

Client has a long 1 unit of US SPX 500 (S&P 500) trade open at 5pm ET Tuesday.

Financing cost = (1 x 3040.50) x 4.00% x 1/365 = 0.33 USD

Result: a financing charge of 0.33 USD, converted to the client’s account home currency, will be levied to their account.

Example 2

Client has a short 10 units of US SPX 500 trade open at 5pm ET Friday.

Financing cost = (10 x 3040.42) x 2.00% x 3/365 = 5.00 USD

Result: a financing credit of 5.00 USD, converted to the client’s account home currency, will be applied to their account.

Examples of financing costs for commodities and bonds (illustrative purposes only)

Examples of financing costs for commodities and bonds (illustrative purposes only)

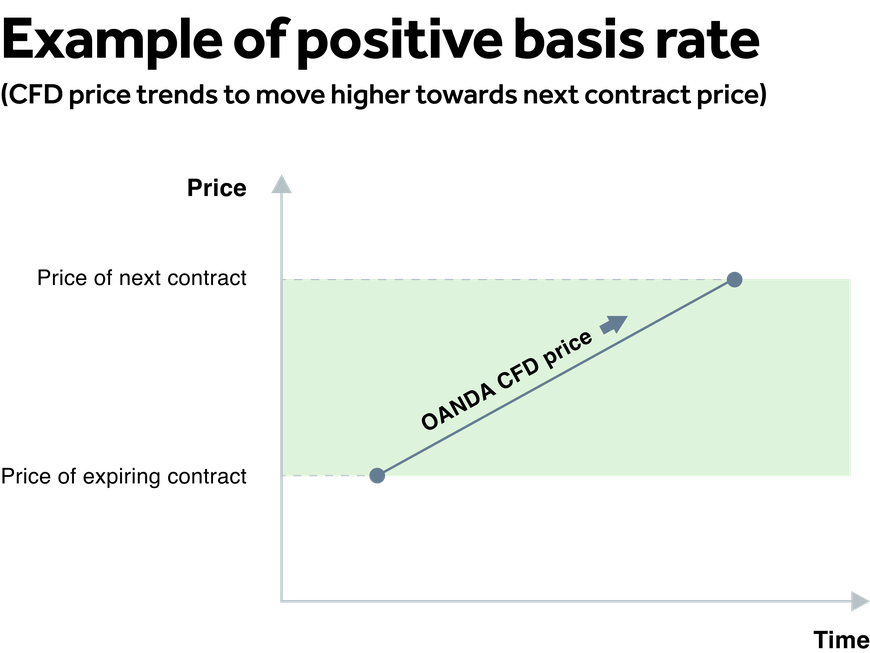

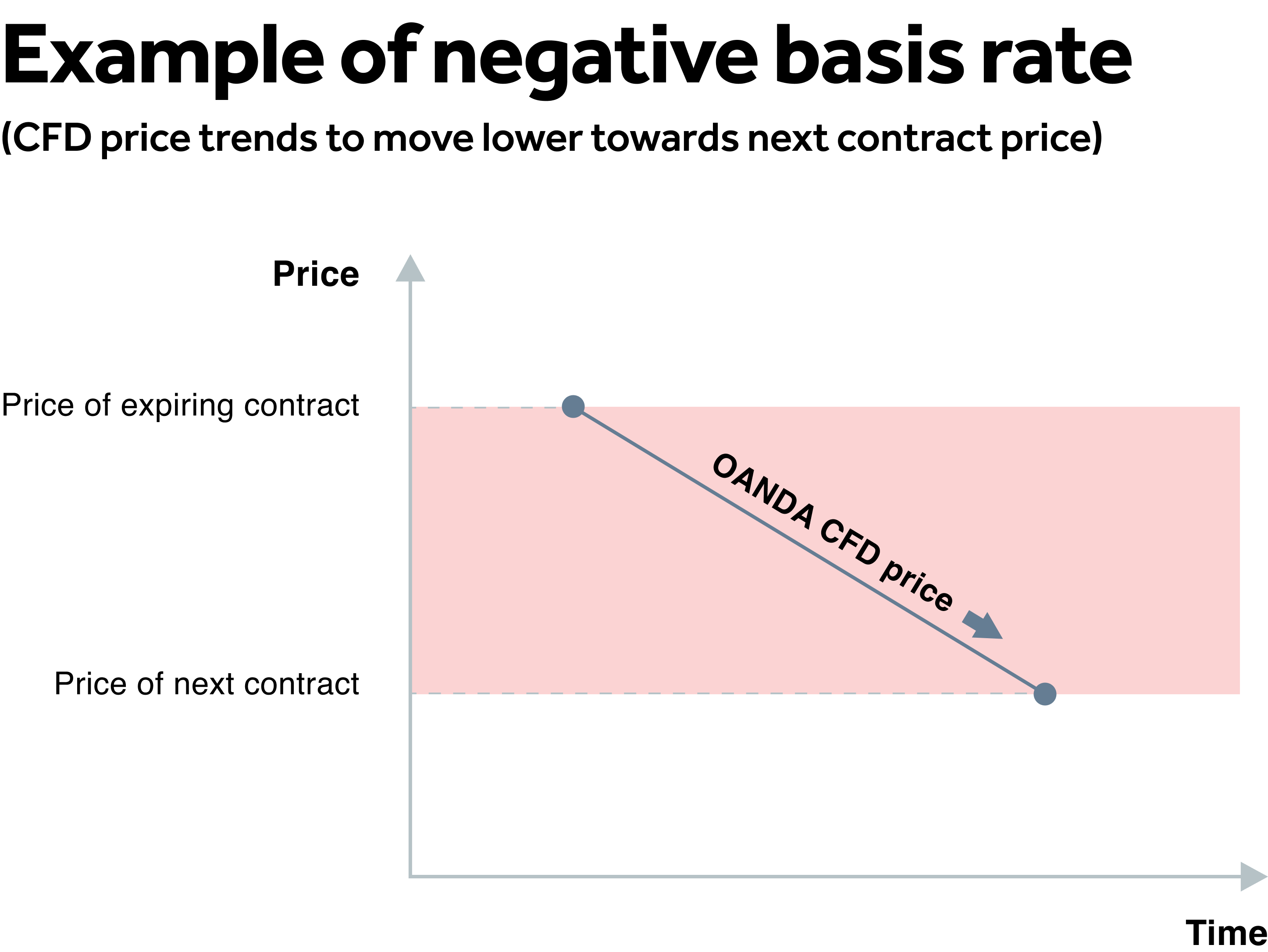

The prices of OANDA’s commodity (including copper and platinum) and bond CFDs are based on underlying active futures contracts. When an underlying futures contract is near expiry, OANDA calculates the basis rate, which represents the difference in price between the expiring futures contract and the next futures contract. From that point forward, the OANDA CFD price is calculated as the present value of the price of the next futures contract, using the basis rate for the present value calculation. The present value is calculated continuously, second-by-second.

When the basis rate is positive, the CFD price will tend to move upwards towards the contract price. When the basis rate is negative, the CFD price will tend to move downwards towards the contract price.

Financing cost = position size x funding rate x trade duration (in days) / 365 x conversion rate to account currency

Financing charges on commodity CFDs and bond CFDs will be calculated on a continuous second-by-second basis. These charges or credits are applied at the close of a trade. Additionally, if you have an open commodity or bond CFD position on your account at the end of each day (5pm ET), including weekends, it will be subject to either a ‘financing charge’ or ‘financing credit’ to reflect the cost of funding your position (in relation to the margin utilised).

OANDA charges financing on commodity (including copper and platinum) and bond CFDs using the basis rate plus an admin fee. The basis rate portion of the financing amount is intended to offset the price movements caused by the present value calculation.

For long positions clients will be debited the basis rate plus a 2.5% admin fee. For short positions, clients will be credited the basis rate minus a 2.5% admin fee.

| Asset | Long positions | Short positions |

|---|---|---|

| Commodities and Bonds | Basis rate + 2.5% admin fee | Basis rate – 2.5% admin fee |

Example 1

The Brent Crude Oil CFD has a basis rate of +5.00%, indicating that the CFD price is likely to move upwards toward the next contract price.

Client has a USD account, and the conversion rate from 1 Brent Crude Oil CFD to USD is 63.00 USD

Client has a 100-unit long position of Brent Crude Oil, which was opened between 3:00am and 3:00pm ET.

Financing amount = position size x funding rate x trade duration (in days) / 365 x conversion rate

Position size = 100Funding rate = (5.00% + 2.50%) = 7.50%TradeThe actual execution of buying or selling an asset, resulting in a completed transaction. duration (in days) = 12 hours = 0.5 days

Financing amount = 100 x (5.00% + 2.50%) x 0.5 / 365 x 63.00 = 0.65 USD

Result: a financing debit of 0.65 USD will be applied to the client's account. In this example, the debit offsets the trading profit that results from the price tending upward.

Example 2

The Brent Crude Oil CFD has a basis rate of +5.00%, indicating that the CFD price will tend upwards toward the next contract price.

Client has a USD account, and the conversion rate from 1 Brent Crude Oil CFD to USD is 63.00 USD

Client has a 400-unit short position of Brent Crude Oil, which was opened between 9:00am ET and 3:00pm ET.

Financing amount = position size x funding rate x trade duration (in days) / 365 x conversion rate

Position size = 400Funding rate = (5.00% - 2.50%) = 2.50%Trade duration (in days) = 6 hours = 0.25 days

Financing amount = 400 x (5.00% - 2.50%) x 0.25 / 365 x 63.00 = 0.43 USD

Result: a financing credit of 0.44 USD will be applied to the client account. In this example, the credit offsets the trading loss that results from the price tending upward.

Example 3

The Natural Gas CFD has a basis rate of -20.00%, indicating that the CFD price will tend downwards toward the next contract price.

Client has a EUR account, and the conversion rate from Natural Gas CFD to EUR is 2.50 EUR.

Client has a 100,000-unit long position of Natural Gas, which was opened between 2:00am ET and 2:00pm ET.

Financing amount = position size x funding rate x trade duration (in days) / 365 x conversion rate

Position size = 100,000Funding rate = (-20.00% + 2.50%) = -17.50%Trade duration (in days) = 12 hours = 0.50 days

Financing amount = 100,000 x (-20.00% + 2.50%) x 0.5 / 365 x 2.50 = -59.93 EUR

Result: since the resulting amount to be debited is negative, a financing credit of 59.93 EUR will be applied to the client account. In this example, the credit offsets the trading loss that results from the price tending downward.

If you have an open position on your account at the end of each trading day (5pm ET), the position is considered to be held overnight and subject to either a ‘financing charge’ or ‘financing credit’ to reflect the cost of funding your position (in relation to the margin utilized).

The financing cost is calculated on a per position basis and may be a debit or a credit, depending on whether the position is a buy/long position or a sell/short position, and depending on the applicable funding rate as described below.

For FX and metal (except copper and platinum) CFD positions:

Daily financing charge or credit = size of position x applicable funding rate x days/365

For index CFD positions:

Daily financing charge or credit = value of position* x applicable funding rate x days/365

*where value of position = size of position x price at the end of trading day (5pm ET)

Funding rates (sometimes called the ‘swap rate’ for FX products) vary from instrument to instrument and may change on a daily basis. They are quoted as an annual rate with two quotes per instrument (one for a buy/long position and the other for a sell/short position). A negative funding rate results in a charge for you, and a positive funding rate results in a credit to you.

The daily financing charge or credit will be claimed/ passed from/ to your account each day and will be visible in your transaction history accessible via your account portal.