What are the margin or leverage rules?

How are margin and leverage related?

How are margin and leverage related?

The size of the positions you can open depends on the margin (deposit from your own capital) and the applicable leverage (use of borrowed capital) for a given instrument. Leverage and margin are mathematically related.

Leverage = 1 / Margin Requirement.

For example, if the margin requirement is 2% (0.02), the leverage would be 1/0.02 = 50/1

50:1 leverage means that for every EUR 1 of your own funds, you can hold a position worth EUR 50 in the market.

How to check leverage available for a specific instrument

How to check leverage available for a specific instrument

Leverage or margin rates depend on each instrument's ESMA regulatory requirement and the account type. First, check your account type, then refer to our website for the current margin rates for each instrument.

The following example explains how to interpret the financial leverage information on our website:

-

The first leverage (30:1) applies to the CFDs account, which is a base account for all OANDA TMS clients.

-

The second leverage (100:1) applies to clients in the Experienced status (only for Polish clients).

-

The third leverage (100:1) applies to a Professional account holder who possesses a broad trading knowledge and experience. Read more about Experienced status for Polish clients and Professional accounts.

How to check the margin required to place an order

How to check the margin required to place an order

OANDA website

OANDA website

Please check instrument specification for margin required.

OANDA mobile platform

OANDA mobile platform

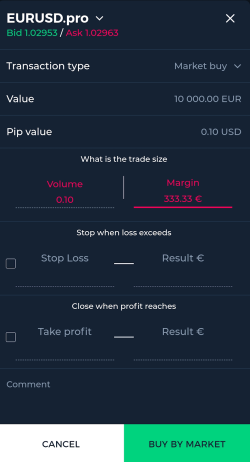

When you enter your order requirements on the OANDA mobile app, the order ticket shows Margin which is the margin required to place that specific order.

In the following example, as per the order ticket on the OANDA mobile app, the margin required for a 0.1 lot trade of EUR/USD would be 333.33 EUR.

Third-party platforms

Third-party platforms

TradingView and MetaTrader order tickets do not provide the required margin calculations.

How to calculate the margin required

How to calculate the margin required

The following examples explain margin calculations for forex and commodities.

Forex example

Forex example

-

Select the instrument you want to trade. As an example, we will use GBPUSD. Let’s assume your account is the CFDs account and your currency is EUR.

-

Check the margin required for the instrument for the relevant account type. You can do so in the instrument specification on our website. You will also need to check the contract size per 1 lot.

-

Select the trade volume in lot. For this example, let’s assume you want to trade 0.1 lot. The following example explains the calculation for 0.1 lot:

Contract size / 1 lot = 100 000 GBP

Therefore, 0.1 lot = 100 000 x 0.1 = 10 000 GBP

Assuming you have the retail CFDs account, the applicable margin required is 3.3333%.

10 000 GBP (contract size per 0.1 lot) x 3.3333% = 333.33 GBP

Depending on the currency of your account, conversion of the margin to the relevant currency may be required. The conversion normally happens taking into account the relevant side, i.e. bid for a short position and ask for a long position.

In the above example, since your account’s currency is EUR, you will need to convert the margin in GBP to EUR. In this example, 333.33 GBP equals around 399 EUR.

Commodities example

Commodities example

-

Select the instrument you want to trade. As an example, we will use GOLD. Let’s assume your account is the CFDs account and your currency is EUR.

-

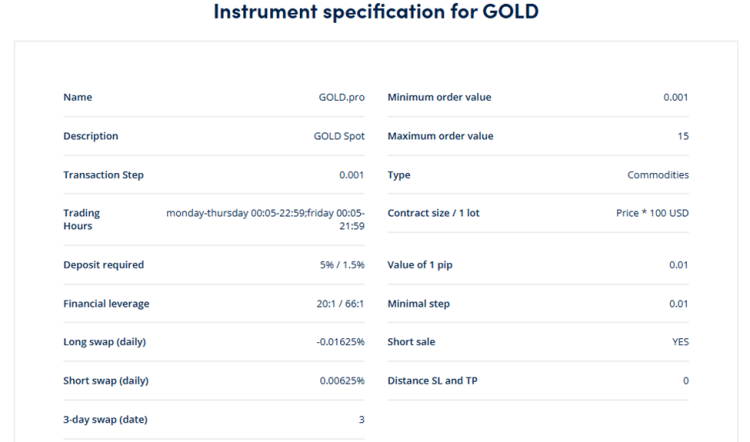

Check the margin required for the instrument for the relevant account type. You can do so in the instrument specification on our website. You will also need to check the contract size per 1 lot.

-

Select the trade volume in lot. For this example, let’s assume you want to trade 0.1 lot. The following example explains the calculation for 0.1 lot:

As per the instrument specification for Gold shown in the previous image, contract size/1 lot is Price x 100 USD which means:

Contract size for Gold CFD = 1 lot = 100 ounces of gold

Trade size in this example = 0.1 lot = 0.1 x 100 = 10 ounces of gold

Contract value = Gold price x Trade size where Gold price is the current bid/ask price.

Contract value for 0.1 lot = 2866 x 10 = 28660 USD

Assuming you have the retail CFDs account, the applicable margin required is 5%.

28 660 USD (contract size per 0.1 lot) x 5% = 1433 USD

Depending on the currency of your account, conversion of the margin to the relevant currency may be required. The conversion normally happens taking into account the relevant side, i.e. bid for a short position and ask for a long position.

In the above example, since your account’s currency is EUR, you will need to convert the margin in USD to EUR. In this example, 1433 USD equals around 1380 EUR.

In case of hedged positions, normal/full margin is calculated for the larger leg trades (whichever buy or sell trade has the larger quantity) or for the long leg if the long and short trade quantities exactly offset).

What is margin level?

What is margin level?

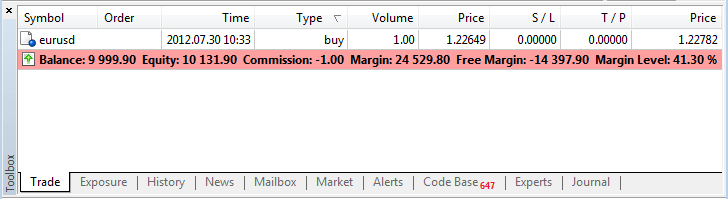

Margin level represents how much of your Equity is currently held as margin against your open positions.

Margin level = (Equity / Used Margin) x 100%

What is a margin call?

What is a margin call?

A margin call is triggered when the margin level is at 100% i.e. you have run out of free funds to place new trades or maintain existing positions. In other words, a margin call is a warning to inform you that the margin level has fallen below the required maintenance margin. When you receive a margin call alert, you must deposit additional funds or close open positions to bring the account back to the required margin level.

What is margin stop-out?

What is margin stop-out?

A margin stop-out is the automatic liquidation of a trader's open positions by their broker when their margin level falls to a specific threshold, preventing the account balance from going negative. In other words, it is a safety mechanism to prevent your account balance from going negative.

According to the law and regulations, when the margin level is close to or equals 50%, a margin stop-out will occur and the most losing position is closed automatically.

If trading is unavailable for certain open positions at the time of the margin stop-out, those positions will remain open and we will continue to monitor your margin requirements. When the markets reopen, another margin stop-out may occur for the remaining positions if your account remains under-margined.

How to avoid margin stop-outs

How to avoid margin stop-outs

Take proactive measures to avoid getting a margin stop-out on your account. For example,

-

Monitor the status of your account continuously.

-

Specify a stop-loss order for each open trade to limit downside risk. You can specify the stop-loss rate at the time you issue a trade, or add a stop-loss order at any time for any open trade. You can also change your stop-loss orders at any time to take current market prices or other conditions into account. Stop loss and take profit orders are not guaranteed; gaps in market pricing may cause your stop loss orders to be filled at a less advantageous price, or your take profit orders to be filled at a more advantageous price than the level you specify.

Your trade is closed at the current OANDA rate, which may vary from your stop loss price - especially when trading resumes after periods of market closure. -

If you happen to be close to a margin stop-out, you can take one of the following actions:

-

Incrementally reduce the size of your positions as you get close to a margin stop-out. For example, if you get a margin warning, reduce the size of all your open positions by 10%. This effectively lowers the amount of margin required, giving you more breathing room.

-

Close individual positions to reduce the amount of margin required.

-

Transfer additional funds into the account from another sub-account.

-

Add funds to the account. However, the time it takes to add funds could mean your funds arrive too late.

-