How to submit the tax declaration for trading Share CFDs and ETF CFDs ? (OANDA Europe Limited)

How to submit the tax declaration for trading Share CFDs

How to submit the tax declaration for trading Share CFDs

and ETF CFDs

?

-

Log in to the HUB.

-

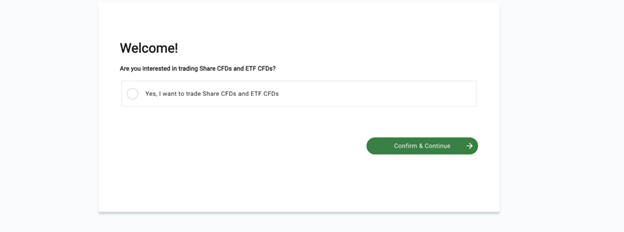

You will notice a message that prompts you to activate Share CFDs and ETF CFDs on your OANDA One sub-account. Click on Start now.

-

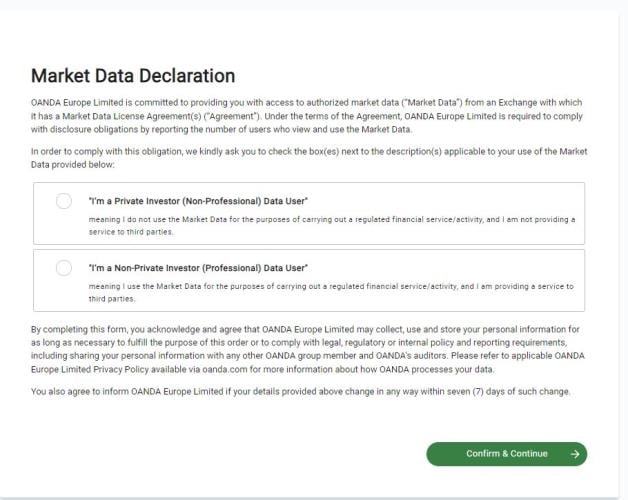

Indicate if you are a private or non-private investor.

-

Confirm your intent and continue.

-

Select your country of birth and continue.

-

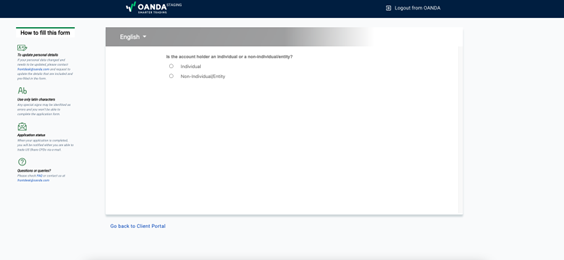

Select Individual or Non Individual/Entity.

-

In case of individuals, indicate if you are a citizen or resident of the United States and click on Continue. In case of entities, confirm whether you are organized or incorporated in the United States.

-

Depending on your response, a relevant tax declaration will be shown to you. Individuals who are citizens or residents of the United States must complete the W-9 form. Individuals who are not citizens or residents of the United States must complete W-8ECI or W-8BEN, depending on their individual circumstances. Entities that are organized or incorporated in the United States must complete the W-9 form. Entities that are not organized or incorporated in the United States must complete one of the following forms: W-8BEN-E, Form W-8IMY, Form W-8ECI or Form W-8EXP. Read the instructions carefully. If you think the shown tax declaration is not relevant to you, you can click on Back and review your previous responses.

-

Depending on the type of tax form, you will be required to review details such as name and address.

-

Most of these sections will be pre-populated with the details provided by you at the time of opening the OANDA account. If you would like to edit these details, please contact our customer service team.

-

This form accepts only latin characters. If the pre-populated personal details contain non-latin characters, you won’t be able to continue. Contact our customer service team and see if we can update our records with any equivalents in latin characters.

-

-

Next, depending on the type of form, you may be required to enter more information such as the treaty country. The United States has entered into various bilateral income tax treaties in order to avoid double taxation. Please consult with your tax advisor if you have any questions concerning this part.

-

Click on Submit.

When will my account be approved for trading Share CFDs

When will my account be approved for trading Share CFDs

and ETF CFDs

?

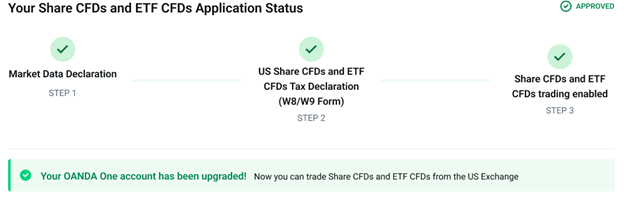

After we review the information, if your account is approved, the Share CFDs

In some cases, the application may require further review. We will review your documents and send you an email when the account is approved for trading Share CFDs

When approved, you must log out and log back in on all platforms. Use the OANDA One sub-account to start trading Share CFDs

My tax declaration is incomplete. How can I resume the process?

My tax declaration is incomplete. How can I resume the process?

If you abandon the process before submitting the form, you can access your incomplete form any time by clicking on the Share CFDs

Can I change the tax declaration submitted for trading Share CFDs

Can I change the tax declaration submitted for trading Share CFDs

and ETF CFDs

?

If you believe that you submitted an incorrect tax declaration, or your circumstances have changed, you can submit a new declaration. Contact our customer support team.

I used to trade in Share CFDs

I used to trade in Share CFDs

and ETF CFDs

. Why am I no longer able to do it?

A change in personal details, such as name, address, tax residence or tax status, invalidates any previously submitted tax declaration. Accordingly, the status of Share CFDs

To submit a new tax declaration, contact our customer support team.

Do I need to submit the tax declaration for Share CFDs

Do I need to submit the tax declaration for Share CFDs

and ETF CFDs

every year?

The tax declaration is valid up to 31st December of the third calendar year after you submit the valid declaration. We will remind you to submit a new declaration before the expiry.

How can I terminate or remove Share CFDs

How can I terminate or remove Share CFDs

and ETF CFDs

trading from my account?

If you would like to stop trading Share CFDs