To add a bank account, follow these instructions:

-

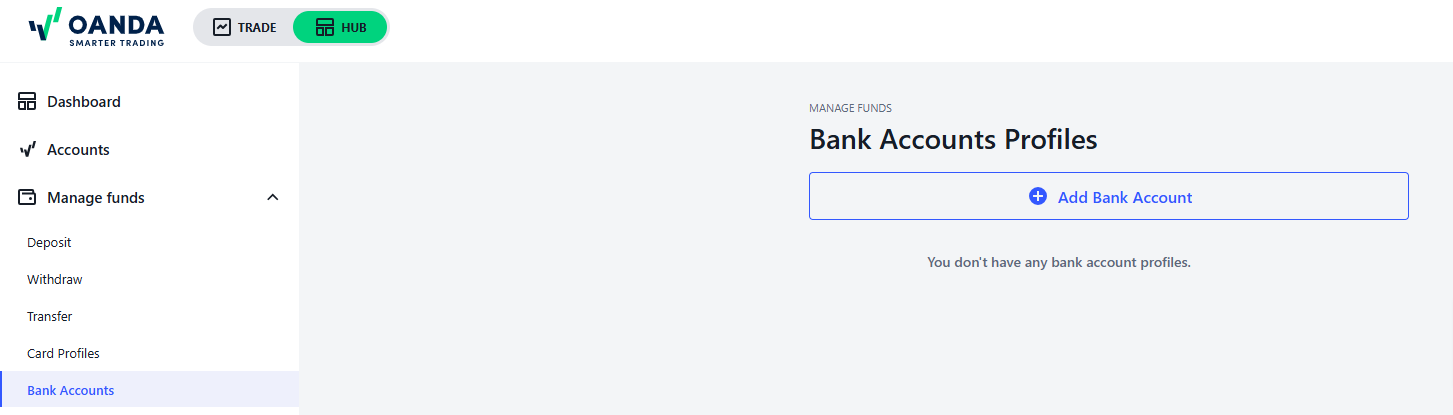

Log in to the HUB.

-

Click on Manage funds.

-

Click on Bank Accounts.

-

Click on + Add Bank Account.

-

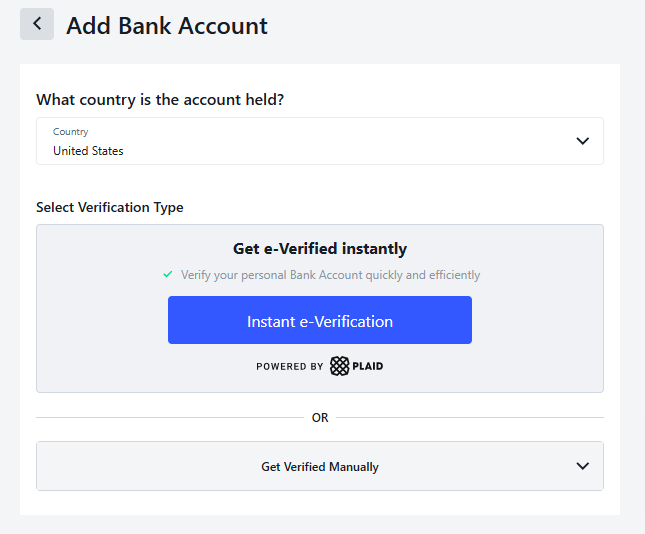

Select the country where the account is held.

-

Verify your personal bank account quickly and efficiently via Instant e-Verification.

-

Alternatively, you can verify your bank account manually by entering required details.

What is Instant Verification and how to do it?

What is Instant Verification and how to do it?

If you have a bank account in the United States, you may be able to use Instant Verification to automatically link your online bank account to your OANDA account. Instant Verification can be a convenient alternative to Manual Verification.

- There is no guarantee that the bank you have an account with is set up for Instant Verification with OANDA. If you are unable to use Instant Verification with your bank, you will have to complete Manual Verification.

- Bank accounts that are e-verified through the Instant Verification process may qualify for Instant ACH deposits. Please note: Capital One accounts are an exception and do not qualify for Instant ACH deposits.

-

Click on Instant e-Verification.

-

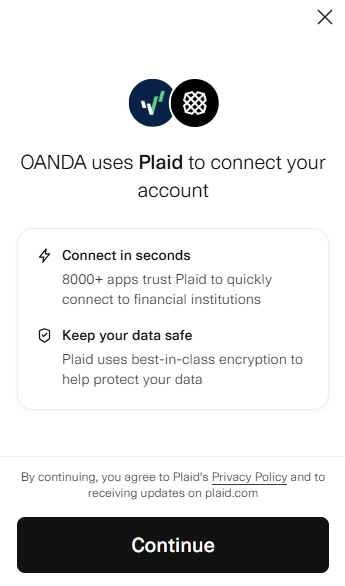

When a new window appears, click on Continue.

-

Enter your phone number.

-

Verify your phone number.

-

Alternatively, you can click on Continue as guest.

-

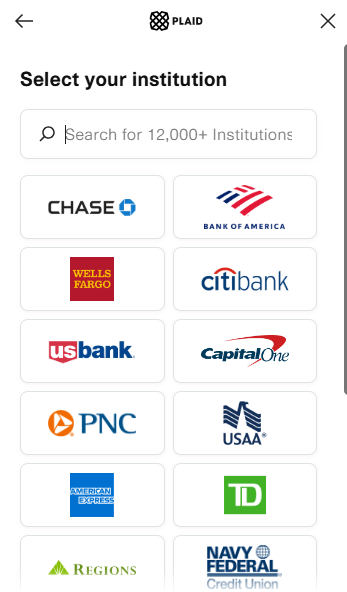

Select or search for your bank that you have an account with.

-

Click on Continue to log in to go to your bank’s login page or enter your online banking credentials and click on Submit. You may be able to select multiple bank accounts at a time for e-verification.

- If you select multiple accounts at a time for e-verification, and one of them fails, all bank accounts will fail to be e-verified. When e-verification fails due to name mismatch, you may go to the Bank Accounts page, click on the dropdown next to the unverified bank account and upload your documents for manual verification.

-

For Chase and Capital One accounts, if you initiate an instant verification, make sure you select previously e-verified accounts as well. If you fail to include previously e-verified accounts, they will be deleted from our system. To restore the deleted accounts, you must go through the Instant Verification process again and include the previously e-verified accounts.

-

When you successfully e-verify a previously (manually) verified Chase account, you will notice the same account twice—e-verified Chase account and (manually) verified Chase account—in the accounts list. You may initiate Instant ACH deposits only through the e-verified account.

What is Manual Verification and how to do it?

What is Manual Verification and how to do it?

Manual verification allows you to verify your bank account by entering your account details manually. Manual Verification also requires you to upload a document from your bank to verify ownership.

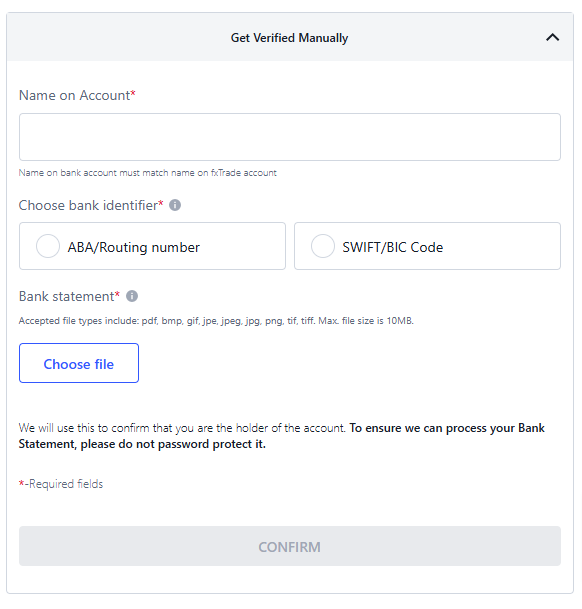

From the Add Bank Account page, click on Get verified manually, and then complete the following steps:

-

Enter the Name on Account. The name on your bank account must be the same as the name you registered with us.

-

Choose a bank identifier from ABA/Routing number and SWIFT/BIC Code options. The ABA/Routing number (used for local transfers in the U.S) and the SWIFT/BIC code (used for international transfers) help to identify your particular bank branch.

-

Enter your ABA/Routing number or SWIFT/BIC Code. If the system can successfully identify the number or code, the bank name and address will be shown below.

-

If you selected ABA/Routing number, select your bank account type as Checking or Saving.

-

Enter your bank account number.

-

Select the currency in which the bank account is denominated in.

-

Upload a bank statement, bank letter or void check which displays your full name, residential address, account number and the bank's logo.

-

Click Confirm to complete.

-

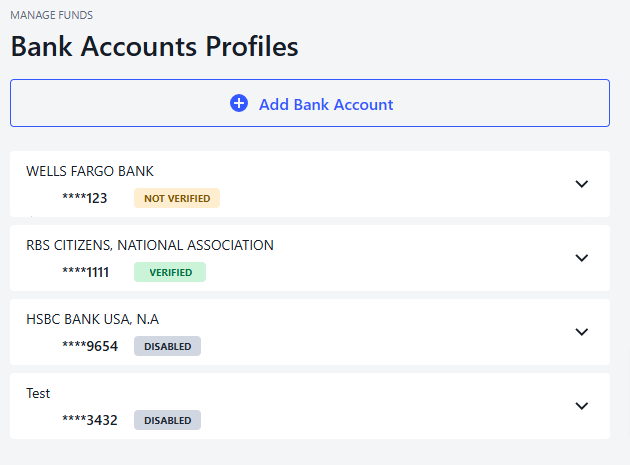

The newly added bank account will have a status of NOT VERIFIED by default.

We will review your newly added bank account and update its status only when you submit an ACH or wire transfer deposit or withdrawal request. The NOT VERIFIED status does not prevent you from submitting such a deposit or withdrawal request. -

You may proceed to deposit or withdraw funds (subject to hierarchy rules) using the new bank account. We will manually verify your bank account and either process your request or send you an email communication for further information.