What are ETFs at OANDA TMS?

What is an ETF?

What is an ETF?

An ETF (Exchange Traded Fund) is an investment fund that tracks the performance of a specific index, commodity, bond, or other asset. An ETF is a passive fund type that operates similarly to stocks – it can be bought and sold on the exchange during the trading day.

Refer to detailed information on ETFs on our website.

What are the main advantages of an ETF?

What are the main advantages of an ETF?

-

Exchange listing—ETFs are bought and sold like stocks.

-

Diversification—Investing in an ETF gives exposure to many assets simultaneously.

-

Low management costs—Most ETFs are passively managed, which means lower fees than traditional investment funds.

-

Transparency—Investors know what a specific ETF invests in because portfolio compositions are published regularly.

-

Flexibility—ETFs can be bought at any stage of the trading day, unlike traditional funds that settle at the day’s end.

Am I eligible to trade ETFs?

Am I eligible to trade ETFs?

You need to have a live account (CFDs account) and a Stocks account.

If you have both accounts, follow these steps:

-

Log in to the Client Zone.

-

Click on FILL NOW on the ETF banner.

-

Complete the MiFID questionnaire.

-

ETFs will be added to your Stocks account for trading.

How to trade ETFs with OANDA TMS?

How to trade ETFs with OANDA TMS?

You can trade ETFs on the OANDA mobile app or MetaTrader 5.

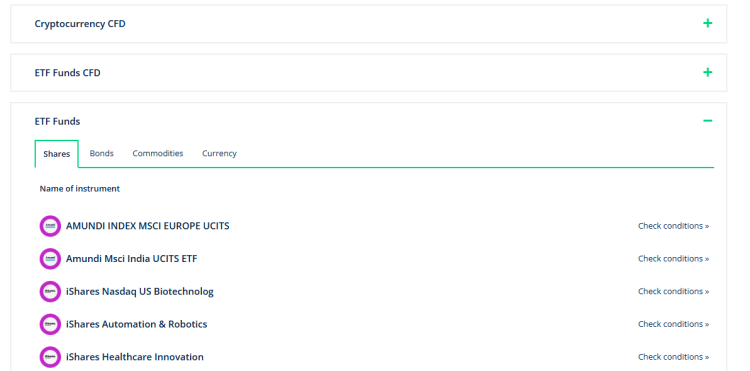

Which ETFs can I trade in?

Which ETFs can I trade in?

Refer to the list of all available ETFs on our website.

What are the minimum and maximum order sizes?

What are the minimum and maximum order sizes?

For the minimum and maximum order sizes, check the desired instrument’s details on the instruments specification page.

Where can I find information about a specific ETF?

Where can I find information about a specific ETF?

Every ETF we offer has a Key Information Document (KID) that provides the following important information:

-

Purpose.

-

Product details.

-

Risks.

-

Costs.

To find a KID, follow these steps:

-

Go to the instruments specification page.

-

Click on the ETF Funds.

-

Click on your desired instrument.

-

In the Specification of the instrument, click on KID.

What is the applicable pricing?

What is the applicable pricing?

For every buy and sell of an ETF, there is a 0.10% commission, with a minimum of 1 EUR /1 USD /5 PLN. For more information, see the Table of Fees and Commissions in the Stocks section on the documents page.

What is the financing cost for ETFs?

What is the financing cost for ETFs?

When you buy ETFs in the spot market, you get immediate delivery. Hence, there is no financing cost.

What are the spreads for ETFs?

What are the spreads for ETFs?

Our spreads are dynamic. For our current spreads, check the desired instrument’s details on the instruments specification page.

What are the trading hours for ETFs?

What are the trading hours for ETFs?

For trading hours, check the desired instrument’s details on the instruments specification page.

Is leverage trading available for ETFs?

Is leverage trading available for ETFs?

Leverage is not available. You can only trade with the funds you have.

Can I short ETFs?

Can I short ETFs?

You cannot short sell.